Web income 50000 gross – Web income $50,000 gross—a giant milestone for lots of. This exploration delves into the meaning behind this decide, inspecting widespread professions and corporations that will acquire it, along with the financial implications and strategic options it unlocks. We’ll moreover uncover the essential variations between gross and net income, equipping you with the knowledge to deal with your funds efficiently.

Understanding the intricacies of income—from the preliminary gross earnings to the last word net income—is important for anyone aiming to learn from their sources. This entire data will illuminate the path in route of financial stability and growth, highlighting smart steps to optimize monetary financial savings, investments, and normal well-being. The journey begins with a clear understanding of the core guidelines, adopted by an in depth analysis of the $50,000 net income scenario.

Understanding Web Income vs. Gross Income

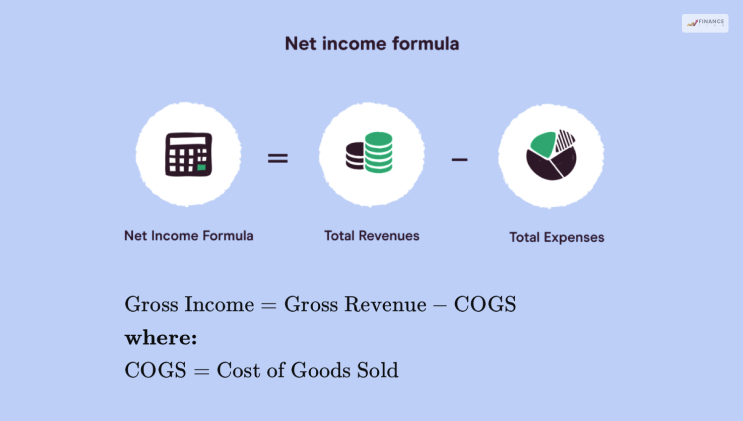

Understanding the excellence between net income and gross income is important for anyone managing personal funds or working a enterprise. These phrases, whereas seemingly associated, characterize distinct financial figures, providing completely totally different views on profitability. Gross income is a elementary measure of entire earnings, whereas net income shows the income after all payments have been deducted. This distinction is important for educated decision-making and financial planning.Web income offers a clearer picture of a corporation’s true profitability than gross income.

It accounts for the costs associated to producing revenue, providing a additional affordable view of the financial properly being of the entity. Gross income, then once more, is an important preliminary measure nonetheless requires further analysis to understand the true financial effectivity.

Key Variations Between Web Income and Gross Income

Gross income represents the entire amount of revenue earned by an individual or enterprise sooner than any deductions are made. Web income, conversely, represents the income earned after all payments have been deducted from gross income. This important distinction permits for a additional right analysis of financial effectivity.

Parts Affecting the Distinction

Fairly just a few parts contribute to the excellence between net income and gross income. These embrace diversified payments akin to working costs, taxes, and curiosity funds. For firms, the excellence may also be influenced by depreciation, amortization, and totally different non-cash payments. Particularly particular person eventualities, deductions for personal payments and taxes are important parts.

An internet income of $50,000 gross suggests a strong financial place, nonetheless managing payments efficiently is important. In case you are searching for to optimize your funds further, understanding strategies to close American Particular card accounts could possibly be important for controlling spending and doubtlessly releasing up funds. Appropriately closing accounts, as outlined on this data how to close american express card , is a good switch that may help you protect a healthful financial profile and acquire your required income goals, given a $50,000 gross income.

Calculation Methods for Gross Income

The calculation of gross income is relatively easy. It often consists of together with up all sources of revenue. For a enterprise, this consists of product sales revenue, funding income, and several types of earnings. For individuals, it consists of wages, salaries, and one other varieties of income. A simple occasion will be summing up all month-to-month wages.

Calculation Methods for Web Income

Web income is calculated by subtracting all payments from gross income. This consists of an in depth accounting of all costs incurred in producing revenue. The tactic is important for determining the true profitability of an entity. A enterprise would possibly want fairly just a few expense courses akin to salaries, lease, utilities, and promoting.

Illustrative Occasion

| Gross Income | Payments | Web Income |

|---|---|---|

| $50,000 | $20,000 | $30,000 |

On this occasion, a gross income of $50,000, with payments of $20,000, ends in an online income of $30,000. This demonstrates the direct relationship between gross income, payments, and the ultimate phrase net income decide.

Analyzing Income of $50,000 Web Income

An internet income of $50,000 can characterize a giant achievement for lots of people and corporations, offering a platform for financial stability and growth. Understanding strategies to leverage this income efficiently is important for attaining financial goals. This analysis explores diversified avenues for maximizing this income potential, from determining applicable enterprise fashions to exploring financial strategies.This income stage permits for a comfortable lifestyle, however as well as presents options for essential monetary financial savings and investments.

The essential factor lies in smart budgeting, strategic spending, and calculated risk-taking. Analyzing potential payments, monetary financial savings, and funding avenues is important for efficiently managing this income stream.

Widespread Enterprise Varieties and Professions, Web income 50000 gross

Quite a few enterprise types and professions can generate a $50,000 annual net income. Freelancing in high-demand fields like web design, graphic design, or content material materials creation is a doable provide of income. Consultants specializing in space of curiosity areas, small enterprise homeowners with setting pleasant operations, and professional tradespeople with a loyal clientele might acquire this stage. Specific particular person professionals, akin to dentists, attorneys, or accountants with established practices, may attain this income stage.

Strategies to Enhance Web Income

Strategies for rising net income often revolve spherical effectivity, market positioning, and revenue optimization. Streamlining operations, leveraging know-how to automate duties, and exploring new market segments can enhance profitability. Setting up a strong on-line presence, making a compelling mannequin, and establishing strategic partnerships can attraction to new shoppers and enhance revenue.

Financial Stability and Points

A $50,000 net income offers a foundation for financial stability, enabling individuals and corporations to cowl essential payments and assemble monetary financial savings. It permits for the creation of a financial cushion in opposition to shocking events and the potential for future investments. However, the extent of financial security will rely on specific particular person or enterprise payments, debt ranges, and personal financial goals.

An internet income of $50,000 gross suggests a healthful financial place, nonetheless important considerations keep. Understanding whether or not or not shelter insurance coverage protection is a worthwhile funding in your desires is important. Is shelter insurance good in your particular circumstances can significantly impression your normal financial properly being, even with a $50,000 gross income. Lastly, this income stage requires cautious financial planning and accountable budgeting.

Financial Planning and Various Analysis

This half analyzes potential payments, monetary financial savings, and funding options primarily based totally on a $50,000 net income. Understanding the allocation of this income stream is important.

An internet income of $50,000 gross often raises questions on financial properly being. Understanding if that income is sustainable, nonetheless, depends upon parts like payments and potential funding options. For example, to learn from a $50,000 gross income, you need to additionally assess your insurance coverage protection desires. Choosing the right insurance coverage protection provider, akin to Plymouth Rock, is important.

Is Plymouth Rock a good insurance company ? This analysis will present you the best way to determine probably the greatest insurance coverage protection decisions in your state of affairs, in the long run affecting the best way you deal with your $50,000 gross income.

| Class | Potential Payments | Potential Monetary financial savings | Potential Funding Options |

|---|---|---|---|

| Housing | Lease or mortgage funds, utilities, property taxes | Down payment for a home, or rental income | Precise property funding trusts (REITs), rental properties |

| Residing Payments | Meals, transportation, garments, leisure | Emergency fund, journey monetary financial savings | Extreme-yield monetary financial savings accounts, certificates of deposit (CDs) |

| Debt Compensation | Loans, financial institution card debt | Debt low cost, lowered curiosity funds | Bonds, diversified mutual funds |

| Healthcare | Insurance coverage protection premiums, medical payments | Properly being monetary financial savings accounts (HSAs), supplemental insurance coverage protection | Properly being-focused shares, or totally different funding options aligned with long-term properly being plans. |

| Taxes | Income tax, state and native taxes | Tax-advantaged accounts (401(okay), IRA) | Tax-efficient funding autos like index funds or ETFs. |

Implications and Options with a $50,000 Web Income: Web Income 50000 Gross

A $50,000 net income presents a giant various for financial growth and planning. This income stage permits for substantial monetary financial savings, investments, and doubtlessly, personal or enterprise enchancment. Understanding the tax implications, funding potentialities, and future planning strategies is important for maximizing the benefits of this income.A $50,000 net income gives a powerful foundation for various financial goals. It permits for a comfortable lifestyle, whereas concurrently enabling the buildup of capital for future desires and aspirations.

Tax Implications

Tax implications fluctuate significantly primarily based totally on specific particular person circumstances, along with location, submitting standing, and deductions. Cautious consideration of tax brackets and potential deductions is essential to optimize financial planning. For example, deductions for dependents, retirement contributions, or residence office payments can significantly reduce the tax burden. Consulting with a licensed tax expert is extraordinarily actually helpful for personalised steering.

Funding Options

A diversified funding portfolio is important for maximizing returns and mitigating risk. Given a $50,000 net income, diversified funding decisions develop to be accessible. Potential investments embrace:

- Shares: Investing specifically particular person shares or exchange-traded funds (ETFs) can provide long-term growth potential. Evaluation and understanding of varied market sectors is important for making educated decisions.

- Bonds: Bonds provide a additional regular return compared with shares, applicable for income expertise or preserving capital. Take into consideration the credit score standing and maturity date when deciding on bond investments.

- Precise Property: Precise property investments, akin to rental properties or precise property funding trusts (REITs), can generate passive income and doubtlessly admire in value over time. Thorough due diligence and market analysis are essential.

Personal and Enterprise Progress

A $50,000 net income permits for funding in personal {{and professional}} enchancment. This might embrace:

- Means Development: Investing in packages, workshops, or certifications to spice up current experience or buy new ones can lead to occupation growth and higher incomes potential.

- Enterprise Enlargement: If entrepreneurial aspirations exist, a $50,000 net income offers a strong capital base for enterprise development, whether or not or not it’s starting a model new enterprise or scaling an current one.

Future Monetary financial savings

Utilizing a portion of the $50,000 net income for future monetary financial savings is important. Examples embrace:

- Retirement Planning: Establishing a retirement fund, whether or not or not by way of a 401(okay), IRA, or totally different retirement accounts, is essential for securing financial stability in later life. Take into consideration diversified retirement funding decisions to align with specific particular person risk tolerance and financial goals.

- Kids’s Education: Planning for kids’s education by way of college monetary financial savings plans (529 plans) or totally different funding autos ensures a protected future for his or her education.

Month-to-month Value vary Template

This desk Artikels a doable month-to-month worth vary framework, assuming a $50,000 annual net income.

| Class | Amount (USD) |

|---|---|

| Housing | 1500 |

| Utilities | 500 |

| Meals | 750 |

| Transportation | 400 |

| Healthcare | 250 |

| Personal Payments | 500 |

| Monetary financial savings | 1000 |

| Investments | 1000 |

| Debt Compensation | 0 |

| Contingency Fund | 250 |

| Full Payments | 5650 |

Discover: It’s a sample worth vary; exact figures would possibly fluctuate counting on specific particular person circumstances and spending habits. Adjustments to this worth vary are extraordinarily actually helpful to meet specific financial goals.

End of Dialogue

In conclusion, a $50,000 net income presents a compelling various for financial planning and growth. By understanding the intricacies of net income versus gross income, strategic planning turns into paramount. This analysis gives a clear path to financial stability, outlining smart steps for maximizing monetary financial savings, investments, and attaining personal or enterprise goals. Take into accout, that’s solely the beginning—regular learning and adaptation are key to long-term success.

Usually Requested Questions

What are widespread payments associated to a $50,000 net income?

Payments fluctuate considerably counting on lifestyle and placement. Housing, transportation, meals, healthcare, and leisure are typical components, nonetheless specific portions will rely on specific particular person choices.

How can a $50,000 net income be efficiently used for funding features?

Funding decisions fluctuate from shares and bonds to precise property. Diversification is important, and a financial advisor can current tailored ideas primarily based totally on specific particular person risk tolerance and financial goals.

What are the potential tax implications for a $50,000 net income?

Tax obligations fluctuate primarily based totally on specific particular person or enterprise building. Consulting with a tax expert is important for navigating these complexities and guaranteeing compliance.

How can any person with a $50,000 net income plan for retirement?

Contributing to retirement accounts, akin to 401(okay)s or IRAs, is essential. Early planning permits for the power of compounding to work in your favor, leading to a protected financial future.